1. Overview

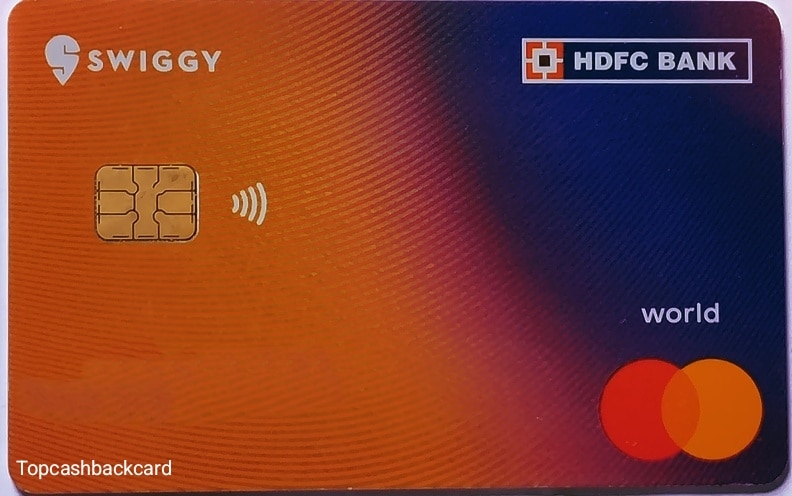

The HDFC Swiggy Credit Card, a co-brand offering with Swiggy and powered by Mastercard World, targets online foodies and shoppers. Earn 10% cashback on Swiggy (food, Instamart, Dineout, Genie), 5% on online Shopping, and 1% on all other transactions.

- Joining fee: ₹500

- Annual fee: ₹500 (waived on annual spends ≥ ₹2 lakh)

- Welcome gift: 3‑month Swiggy One ₹1,199 subscription

2. Rewards & Cashback for HDFC Swiggy Credit Card

| Spend Category | Cashback % | Monthly Cap |

|---|---|---|

| Swiggy (food & more) | 10% | ₹1,500 |

| Online purchases | 5% | ₹1,500 |

| Other spends | 1% | ₹500 |

Total potential annual cashback: ₹42,000

✅ Per-use cashback credited as statement credit, making it effortless to redeem .

3. Perks & Features

- Swiggy One membership – Free for 3 months; ties directly into Swiggy orders

- Mastercard World extras – Includes golf lessons/green fee experiences

- Smart EMI facility – Convert high-cost purchases into easy, low-interest EMIs

- Contactless & International – 50‑day interest‑free credit and global usability

4. Fees & Waivers

- Joining/annual fees: ₹500 + GST (~₹590)

- Waiver condition: ₹2 lakh annual spending (excludes wallet loads, utility bills, cash, etc.)

- Other charges: Standard interest (~45% p.a.), late-payment penalties, cash advance fees ~2.5% (min ₹500)

5. Who It’s Best For

Ideal users include:

- Regular Swiggy customers (food, groceries, dine-out, Genie)

- Frequent online shoppers – Amazon, Myntra, electronics, cabs, pet care, etc.

- Beginners wanting easy cashback without managing point programs

6. Pros & Cons Of HDFC Swiggy Credit Card

✅ Pros

- Simplified cashback model

- Robust rewards on Swiggy & online buys

- Valuable Swiggy One subscription

- Fee waiver possible with moderate spending

⚠️ Cons

- Modest caps may limit high spenders

- No lounge access

- Cashback excludes some categories like rent, insurance, wallets, fuel

7. Final Verdict for HDFC Swiggy Credit Card

If you frequently order through Swiggy and make regular online purchases, this card is a no-brainer. With straightforward cashback, easy redemptions, and a complimentary Swiggy One membership, you can cover the ₹500 annual fee with just one month’s use.

Spending ₹15k/month on Swiggy + ₹30k online + ₹50k offline could yield ₹3,500/month cashback → ₹42k/year

Summary

- Excellent for Swiggy and e-commerce savers

- Transparent cashback with no fuss redemptions

- Modest fee that’s easily offset

- Great entry-level card for digital lifestyles