Choose Your Spending Category

Tell us where you spend the most — online shopping, fuel, food delivery, or travel. Our comparison engine filters the best cashback card for your exact needs.

Honest Cashback Credit Card Comparison for Indian Spenders

Earn up to 5% cashback on every purchase. Compare India's top cashback credit cards from SBI, HDFC, ICICI & Axis — and find the card that matches your spending in seconds. Free, unbiased, and updated monthly.

Side-by-side comparison of India's highest-rated cashback credit cards — fees, rewards, and welcome benefits at a glance.

| Card Name | Cashback Rate | Annual Fee | Best For | Welcome Offer | Rating | Apply |

|---|---|---|---|---|---|---|

SBI Cashback Credit Card State Bank of India |

5% Online | ₹999 + GST | Online Shopping | 5% cashback instantly | ⭐ 5.0 | Apply Now |

Amazon Pay ICICI Card ICICI Bank |

5% Amazon | Free Forever | Amazon Shopping | ₹2,000 voucher | ⭐ 4.6 | Apply Now |

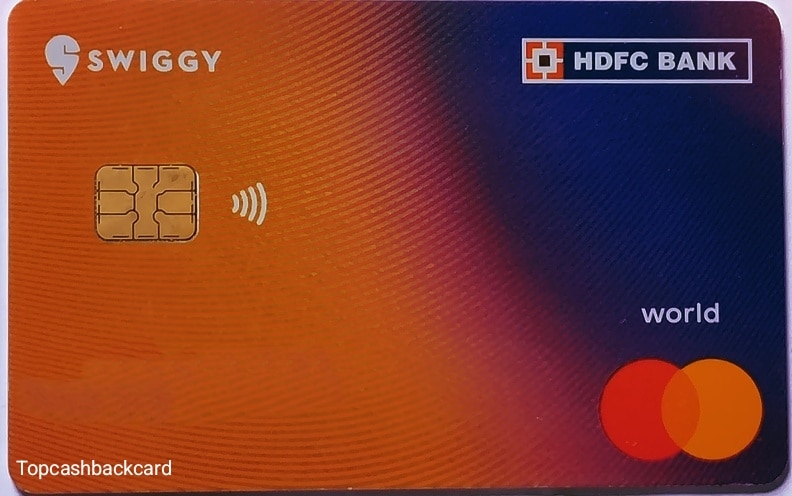

Swiggy HDFC Bank Card HDFC Bank |

10% Swiggy | ₹500 + GST | Food & Dining | 3-mo Swiggy One | ⭐ 4.8 | Apply Now |

HDFC Millennia Card HDFC Bank |

5% SmartBuy | ₹1,000 + GST | Online + Dining | ₹1,000 voucher | ⭐ 4.5 | Apply Now |

Flipkart Axis Bank Card Axis Bank |

5% Flipkart | ₹500 + GST | E-Commerce | ₹500 Gift Card | ⭐ 4.6 | Apply Now |

Airtel Axis Bank Card Axis Bank |

25% Airtel | ₹500 + GST | Utilities + Recharge | 25% cashback recharge | ⭐ 4.7 | Apply Now |

Apply for a cashback credit card in under 5 minutes — no paperwork, no branches, no confusion.

Tell us where you spend the most — online shopping, fuel, food delivery, or travel. Our comparison engine filters the best cashback card for your exact needs.

View side-by-side cashback rates, annual fees, capping limits, and welcome benefits. Our expert scores help you spot the best value instantly — no jargon.

Click "Apply Now" and you're taken directly to the official bank portal. All processing is done by the bank — your data never passes through us.

Ranked by our editorial team based on cashback rates, fee value, redemption ease, and real user reviews. All cards link to official bank applications.

A cashback credit card returns a percentage of your spending directly to you — as a statement credit, bank transfer, or reward points convertible to cash. Unlike traditional reward points, cashback is straightforward: spend ₹10,000 on a 5% cashback card and get ₹500 back. No redemption hassles. No points expiry.

In India, cashback credit cards have become the smartest financial tool for everyday spending. Whether you shop on Amazon and Flipkart, order from Swiggy and Zomato, or pay fuel bills at HPCL and BPCL pumps — there's a card designed to give you cashback on every rupee.

"Switched to the SBI Cashback card after finding it on TopCashbackCard. Earned ₹4,200 cashback in just 3 months on my regular Myntra and BigBasket orders. The comparison tool made it so easy to understand."

"I was confused between 6 different credit cards. This website showed me a clear comparison. Got the Amazon Pay ICICI card — lifetime free and the ₹2,000 welcome voucher was credited immediately."

"As someone who orders Swiggy almost daily, the HDFC Swiggy card was a game changer. I earn back ₹1,200–1,500 every month. TopCashbackCard helped me find it in 2 minutes flat."

Answers to India's most searched cashback credit card questions — plain language, no bank jargon.

In-depth guides to help you earn maximum cashback — updated regularly by our editorial team.

Complete breakdown of the SBI Cashback Card — rewards, fees, capping, and whether it beats free alternatives.

Read Full Review →The only list you need of truly free cashback credit cards with no hidden annual charges in India.

Read Full Guide →Head-to-head comparison of India's two most popular e-commerce cashback cards — who wins in 2025?

Read Comparison →We never store your financial data. All card applications happen directly on official, RBI-regulated bank websites. TopCashbackCard is a comparison platform — not a bank, lender, or NBFC.